This post is inspired by my friend Matt Mort’s YouTube series on money! Check out his latest video at the end of this post!

I’m a believer in de-stigmatizing conversations around finance. We live in a culture where money is (unfortunately) tied to our sense of self-worth, and as a result, money not only affects our lives but also our personalities. However, I’ve never had much to offer the conversation. I mean, literally, I’ve never had much. (I once sold 14 inches of my hair when my bank balance was $4.) Money in the creative industry is especially difficult to talk about, but that’s also why it’s even more important to talk about it.

Years ago, I read/saw an interview with Andrew Phung—Canadian celebrity and altogether great guy—somewhere. He explained that before he was famous, he set a goal of making at least as much from his creative jobs as he had from the full-time job he’d left. If it was nearing the end of the month and he hadn’t reached his goal, he’d have to hustle and take odd jobs to meet his minimum. It blew my mind; the idea of being able to make enough money from creative pursuits to sustain a regular life without having the pull of a big shot celebrity. It was the first time I’d considered that kind of life was possible for normal people.

Financially, 2022 and 2023 were shit years for me. I started 2022 working a full-time job as a writer and, although it covered the basics of living, I couldn’t afford to sign up for acting classes that spring. Over the summer, I got into the CFC and all of a sudden found myself quitting my job (goodbye sweet stable income!) and moving to Toronto (hello increased cost of living!) with about six weeks’ notice (and my savings shrank in that time due to poor choice of company). From September 2022 to February 2023, I survived off subsidies, occasional freelance writing gigs, and my emergency fund. I lived frugally and barely made it work.

In March 2023, I finished at the CFC and no longer got subsidies, but also had no job, and had to make a trip to Calgary and back in April. I made about two hundred bucks per month in March and April. I was hemorrhaging money, and the only reason things didn’t get really bad for me was because of the privilege of having a middle-class dad willing to gift me enough to keep my head above water. He gave me $2500 to make work across March and April, which combined with my earnings meant I was living off of $1450 per month.

On May 1st, I started a new job as a restaurant hostess. The pay was not quite as good as my full-time job but the work was more demanding and exhausting than any job I’ve ever had. Over the summer, I was working 6 days a week which was good because my writing gigs had dried up and Skipper needed dental surgery. I made it through the summer with a comfortable cushion…and then September hit, and it all stopped.

I took two weeks off to attend my first-ever Toronto International Film Festival, then took another two weeks because I got my first case of COVID from said festival. When I finally went back to work after a month of no income, patio season was over and everyone’s hours had been slashed. I went from six days a week to three hours a week. Luckily, I started making a bit of money from acting around this time, then managed to find a second part-time job as a receptionist, only to have an unexpected 2-week trip to Calgary in December for my grandma’s funeral. From September to December, I was making half what I made over the summer, and finished every month in the red.

I started January with my two part-time jobs, the sporadic acting work, and managed to scrounge up some more regular writing gigs. If you’re counting, that’s four jobs. I took stock of what the hell my finances have gone through over the previous two years, so volatile and inconsistent that I’d never been able to make or keep any sort of plan or budget. In surplus months I added to my savings, and in short months I took from them. By January, my emergency fund and bank balance were shot, but I also had no debt and my credit card balance was paid off. I was basically starting fresh. Not ideal, certainly, but not terrible either. I also looked at my spending from September to December because I knew my spending was as minimal as I could realistically manage in those months, compared to the summer when I naïvely thought my financial woes were over and was a little freer with my spending.

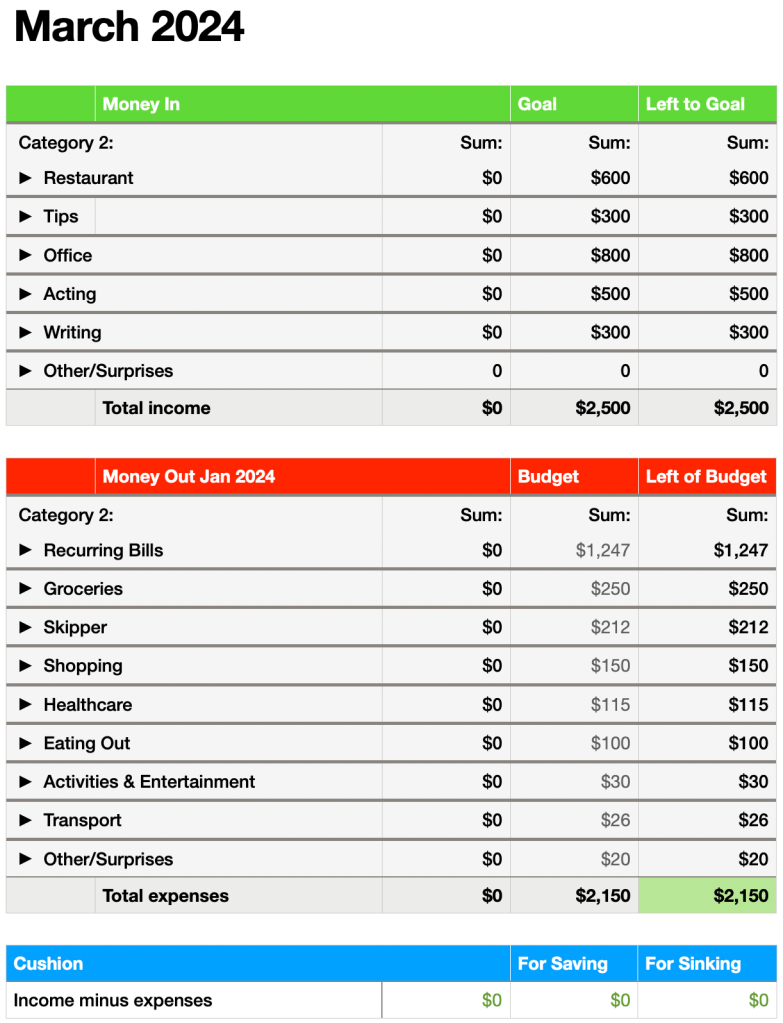

Using my minimal spending patterns, I drew myself up a budget that, though tight, I could realistically keep to if necessary. It amounted to $2000, including savings and rent, which is low for anyone living in Toronto. In 2023, with all my highs and lows, my average monthly income was $2290, so I made it my goal to make at least $2000 a month, thinking that should be easy enough. Through January, I tracked not only the money I made, but every cent I spent. It felt kind of like a game, trying to lower my spending number and increase my earning number. My highest priority is to make rent, second highest is to pay off my credit card in full each month. Priority #3 is $250 per month for a visit home in August. Priority #4 is to fill my depleted emergency fund with a goal of $6k as fast as possible. I went slightly over budget in January (by $69) but after all my priorities were taken care of, I won the game by $190. It was tight, but I did it.

February started with me getting my full actors’ union membership and I had to pay $861 in dues that I hadn’t expected or planned for. I’d levelled up, but the game was getting harder. I also needed to make sure I had 30% of my 2023 self-employed income for tax season come March. I got lucky and got the payout from previous months’ acting work and did more this month which I’ll probably be paid for next month. I started serving at my restaurant job and took on more writing work, resulting in an extra five hundred-ish dollars. Including the union dues, I’ve spent $2983 of my $2k budget, and there are two days left in the month. But I’ve also made $4028. Amazing! I’m doing it! I’m making a living while pursuing my passion!

BUT I need another sinking fund. There will be more months like this one with annual membership fees, subscriptions, birthdays, holidays, vet checkups, acting classes, dentist appointments and whatnot. There are additional costs that aren’t monthly but that I know are coming and need to be ready for. This will be Priority #5, after rent, credit card, emergency fund, and my Calgary travel fund.

My objective with this budget is to be able to predict and control how much I will spend as well as allow myself the freedom to spend within those budgets. Allocating money specifically for things like eating out, shopping, or entertainment helps to alleviate the guilt of spending on what may not be basic necessities but do improve my quality of life in significant ways. Every month for two months now, I’ve tweaked the budget for accuracy. I’ve gone over-budget both months, which tells me I’m not budgeting enough for things, so I’m upping it from $2k to $2150. On the other hand, I’ve increased my income goal from $2k to $2500, with specific targets for each of my income streams. So this is my budget for March:

At the end of March, maybe I’ll write a post with details about what I earned and how I used it. Let me know in the comments if that’s something you’d be interested in, and feel free to leave your thoughts or questions.

If you’re interested in seeing how another creative pursuer handles their money, check out my friend Matt’s video below, and find more on his YouTube channel!

Featured photo by Jason Leung on Unsplash